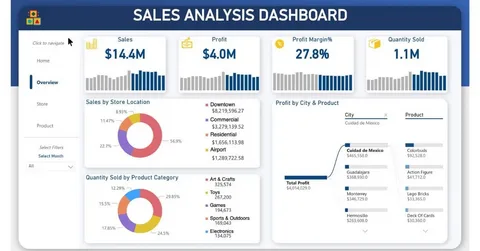

Trader dashboard using trade 1000 urex strategy on synthetic markets

The concept of trade 1000 urex is gaining momentum among traders aiming for structured exposure in digital assets and derivatives. UREX offers a streamlined yet technically advanced environment for trading multiple instruments including forex, crypto, commodities, and synthetic indexes. Trading at the 1000 unit level allows intermediate traders to engage in strategic execution while preserving capital and controlling risk exposure. This trading volume is favored by those building position management skills without diving into high-frequency or institutional scales.

Understanding the UREX Platform

UREX is a modern multi-asset platform offering transparent execution, tight spreads, and a variety of instruments. It supports margin trading, has integrated analytics, and offers high-speed order matching, making it suitable for structured trade volumes like 1000 units. The platform is designed with risk profiling in mind, allowing users to set limits, monitor real-time metrics, and automate trades through advanced bots or manual controls.

What Trade 1000 Urex Means for Traders

Trading with a 1000-unit configuration refers to opening positions where the contract size or trade value equals 1000 units of the underlying asset. On UREX, this may apply to tokens, currencies, or contracts on synthetic indexes. The model balances trade efficiency with risk containment and allows easy adaptation to various strategies such as momentum, mean reversion, or breakout trading.

This model is often used for intraday entries, short-term swings, and news-driven trading environments. It is ideal for traders who are past the beginner phase but not yet operating at institutional scale.

Strategic Benefits of the 1000 Urex Model

-

Entry into synthetic indexes without overexposure

-

Compatibility with both manual and automated trading setups

-

Scalable with margin or compounding strategies

-

Fits well with volatility-based systems and trend following

This strategy is particularly effective for markets with frequent but manageable volatility. Most users pair it with dynamic stop-loss levels and trailing exits to lock in gains.

Account Requirements and Setup

To begin trading 1000 units on UREX, users must verify identity, configure their trading dashboard, and deposit sufficient margin. Capital requirements will vary depending on asset type and leverage. The platform supports deposits in multiple fiat and crypto formats and gives traders access to comprehensive data analysis features including historical charts, volume metrics, and real-time news integration.

Best Practices for Trade 1000 Urex Execution

-

Use trade journals to track performance

-

Apply risk-to-reward ratios on every entry

-

Avoid emotional trading during market spikes

-

Test strategies using demo before switching to live capital

-

Reassess market conditions daily before opening positions

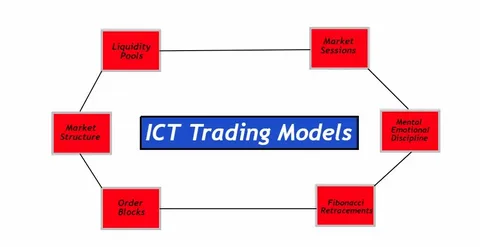

Trade 1000 urex users often integrate custom scripts or indicators such as RSI, MACD, Fibonacci levels, and EMA crossovers to time entries and exits more accurately.

Asset Selection for 1000 Unit Trades

The most compatible assets for this trade size are:

-

Synthetic volatility indexes

-

High-volume cryptocurrency pairs

-

Commodities such as oil and gold

-

Forex majors with predictable movement

Traders should avoid thinly traded pairs or illiquid markets where slippage can eat into profit margins. Consistency is often found in synthetic assets with controlled volatility windows.

Scaling the Trade 1000 Urex Strategy

Scaling from the 1000-unit model is achievable by compounding profits or adding asset diversity. However, scaling should be gradual and aligned with performance reviews. Some traders opt to double their position size every time they achieve a monthly gain threshold, while others introduce hedging or multi-asset portfolios.

The most critical step is risk adaptation. As trade size increases, the need for risk overlays and adaptive margin controls becomes essential.

Discipline and Trading Psychology

No strategy works without discipline. A trader operating with the trade 1000 urex model must build a psychology framework based on logic, patience, and self-auditing. Many failed trades are due not to the system but to behavioral biases such as fear, revenge trading, or overconfidence.

Experienced traders recommend setting fixed time slots for trading, using checklists before entry, and reviewing trades daily or weekly. A strong mindset is what separates long-term success from erratic losses.

Conclusion

The trade 1000 urex strategy stands out as a structured method for participating in global markets with a mid-level commitment that is both practical and strategic. It allows traders to grow skills, develop discipline, and explore asset classes with measurable exposure. The UREX platform supports this method with all necessary tools, making it a reliable choice for consistent performers.

For more finance and trading insights, visit Magazines Break.

FAQs

What is trade 1000 urex in trading?

It is a trading method using 1000 units of capital or asset volume on the UREX platform across different financial instruments.

Is UREX safe for trading?

UREX is known for its regulatory compliance and secure trading infrastructure.

What markets can I trade using the 1000 model?

Crypto pairs, forex, synthetic indexes, and some commodities are best suited for this strategy.

Do I need margin to trade 1000 urex?

Margin is recommended for higher flexibility but not mandatory, depending on asset volatility.

Can I automate the trade 1000 strategy?

Yes, UREX supports automated trading using scripts, APIs, and built-in bot integrations.

What tools are best for trade 1000 urex?

Bollinger Bands, RSI, Fibonacci retracements, and moving averages are commonly used.

Is the 1000 model suitable for beginners?

It is better suited for intermediate users due to capital exposure and execution complexity.

How much capital is needed for trade 1000 urex?

Capital depends on the asset’s unit price. Leverage may reduce required margin.

How can I reduce losses in this strategy?

Use stop-losses, avoid overtrading, maintain a journal, and review trades consistently.

Is this model scalable over time?

Yes, with consistent performance and risk management, it is scalable through compounding or diversification.