A business owner consulting with a mywebinsurance.com insurance expert

Understanding mywebinsurance.com Business Insurance

mywebinsurance.com business insurance is a tailored solution for companies seeking protection against financial losses, legal liabilities, and operational disruptions. With coverage options for small businesses, growing enterprises, and corporate structures, the platform offers personalized policies based on industry, risk level, and business goals.

Choosing the right business insurance impacts not just legal compliance but the long-term survival of your enterprise. mywebinsurance.com simplifies this decision by offering a digital experience backed by licensed carriers, real-time quotes, and industry-specific coverage.

What Makes mywebinsurance.com Business Insurance Unique

mywebinsurance.com stands out by blending technology with deep insurance expertise. Business owners can receive quotes, compare policies, and buy coverage without traditional paperwork or long waiting times.

The site is structured to help business owners:

-

Understand their legal and operational risk

-

Select insurance products tailored to their industry

-

Access ongoing support from licensed insurance agents

-

Modify and manage policies digitally

The convenience of this model appeals to entrepreneurs who want reliable coverage without the outdated complexity of traditional brokers.

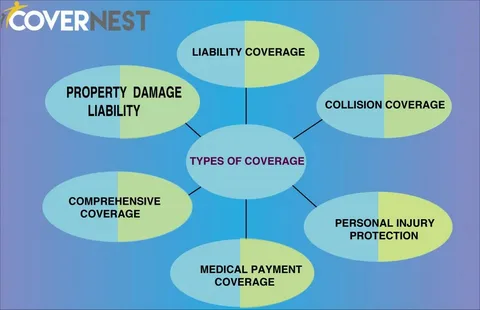

Types of Coverage Offered by mywebinsurance.com

General Liability Insurance

This protects businesses against third-party claims involving bodily injury, property damage, or reputational harm caused by business operations.

Commercial Property Insurance

Designed for businesses with physical assets, this policy covers loss or damage caused by theft, fire, storms, or vandalism.

Professional Liability Insurance

Also known as errors and omissions insurance, it protects businesses that provide consulting, legal, design, or technical services.

Business Owners Policy

Ideal for small businesses, this package combines general liability and property insurance into one bundled plan.

Workers Compensation Insurance

Provides medical benefits and wage support to employees injured on the job. Required by law in most states.

Cyber Liability Insurance

Protects businesses from the consequences of data breaches, system hacks, and digital theft involving customer or business data.

Industry Solutions Tailored by mywebinsurance.com

mywebinsurance.com business insurance offers plans designed to meet the risk profiles of specific industries. This means your coverage aligns with your operational realities, regulatory expectations, and customer relationships.

Examples of Industry-Focused Solutions

-

Tech companies needing cyber and intellectual property protection

-

Restaurants requiring equipment coverage and liability for customer injuries

-

Retailers looking for product liability and inventory coverage

-

Contractors needing tools coverage and site-specific general liability

This industry customization allows businesses to avoid paying for unnecessary coverage while ensuring they are protected where it matters most.

Benefits of Using mywebinsurance.com for Business Insurance

The platform offers several advantages for companies seeking modern, flexible insurance:

Speed and Accessibility

Businesses can get insured quickly through an online form. The platform delivers quotes in real time and allows digital policy binding.

Transparency

Policy terms, pricing, and coverage details are clearly presented so business owners understand exactly what they are purchasing.

Licensed Support

All coverage is underwritten by licensed providers. Support is available through phone, email, or live chat from certified insurance agents.

Flexible Payments and Renewals

Users can choose between monthly or annual billing and receive automatic policy renewal reminders.

Getting Started with mywebinsurance.com Business Insurance

Signing up is straightforward. To start, you’ll need to provide:

-

Your business name and structure

-

Location and number of employees

-

Revenue estimates

-

Industry classification

-

Any prior claims history

The system uses this information to generate personalized quotes. You can then compare providers, adjust policy limits, and choose the best fit for your budget and compliance needs.

Claims and Customer Support

If your business experiences a loss, you can file a claim directly through your online portal. The dashboard allows you to upload documents, track progress, and speak with an adjuster. The support team is known for its fast responses and thorough communication.

Success Story

A boutique digital marketing agency in Dallas experienced a data breach through a third-party software vendor. Thanks to their cyber liability policy from mywebinsurance.com, they recovered forensic costs, legal fees, and client notification expenses. The incident was resolved without affecting their client contracts or reputation.

Why mywebinsurance.com Outperforms Traditional Insurance Brokers

-

Faster process from quote to coverage

-

Clear, jargon-free policy summaries

-

24/7 access to policy documents

-

Ability to update your coverage as your business evolves

In a competitive and unpredictable environment, digital insurance management is becoming a necessity rather than a luxury.

Final Thoughts

mywebinsurance.com business insurance empowers companies to operate confidently. Whether your risks involve data, physical assets, customer interactions, or compliance, the platform provides effective solutions at competitive rates. For businesses seeking simplified, secure, and scalable coverage, mywebinsurance.com is a smart and strategic option.

For more business tools and strategies, visit Magazines Break and stay informed about trends shaping the future of entrepreneurship.

Frequently Asked Questions

What is mywebinsurance.com?

It is a digital platform offering customizable business insurance policies from licensed insurance providers.

Is the service trustworthy?

Yes, all policies are underwritten by certified insurers, and customer reviews highlight transparency and reliability.

Can startups use mywebinsurance.com?

Yes, it offers flexible plans for new businesses with limited budgets and short operational history.

Does it offer cyber liability insurance?

Yes, businesses can secure protection against cyber attacks and data loss incidents.

How long does it take to get a quote?

Most quotes are generated in under five minutes after entering business details.

What if I have a unique business model?

The platform uses industry classification codes to match coverage options to your specific business needs.

Can I manage my policy online?

Yes, you can download documents, make payments, and update coverage through your account dashboard.

Are claims handled digitally?

Yes, claims can be submitted and monitored online with access to live support.

Is there a minimum revenue requirement?

No, businesses of all sizes and revenue brackets can get insured.

What types of payments are accepted?

Most major credit cards and ACH transfers are accepted for policy purchases and renewals.