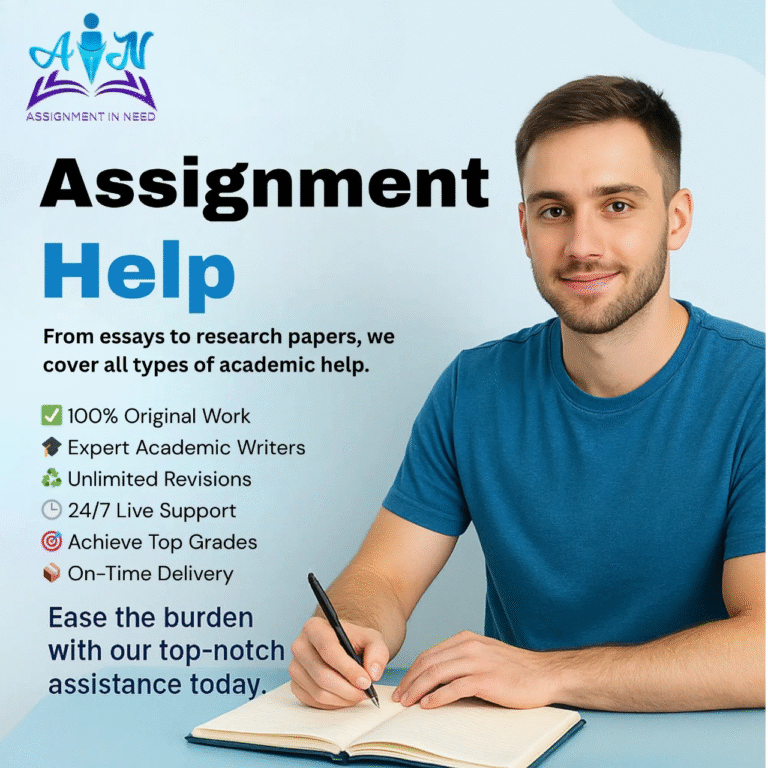

Budget planning dashboard from gomyfinance.com

gomyfinance.com create budget is a feature that helps individuals take control of their personal or household finances by simplifying the budgeting process. This guide explains what the tool does, how to use it effectively, and why it’s a valuable option for people looking to manage their money better without complex spreadsheets or manual calculations.

What is the gomyfinance.com create budget feature

The create budget feature on gomyfinance.com allows users to set a structured plan for their income and expenses. This tool is designed to offer clarity over how money is earned, spent, saved, or invested. Instead of tracking everything manually, gomyfinance.com provides an interactive dashboard where you can input and categorize your financial activity. Once your budget is created, you can monitor your spending patterns, adjust categories as needed, and track savings goals over time.

Why gomyfinance.com create budget is important

Creating a budget is not just about knowing where your money goes. It is about financial discipline, stress reduction, and long-term planning. The gomyfinance.com create budget tool eliminates the need for financial guesswork by offering a dedicated platform to input and analyze every aspect of your financial life. This tool helps with:

-

Preventing overspending

-

Identifying financial leaks

-

Planning for emergencies

-

Saving for future goals

-

Avoiding debt traps

When used consistently, this budgeting tool makes financial behavior more transparent and manageable.

How to access the create budget tool on gomyfinance.com

To use the create budget feature, start by visiting gomyfinance.com and signing up with your email address. Once inside the dashboard, navigate to the Budget section. The system will prompt you to input your sources of income first. After that, you will categorize your regular monthly expenses. The categories can be customized depending on your lifestyle, including rent, groceries, utilities, transportation, entertainment, subscriptions, debt payments, and savings.

After assigning specific budget amounts to each category, gomyfinance.com generates a summary view showing how your total income compares to your total spending. This overview updates automatically as you add transactions or make changes, making it easier to stay on track.

Best practices when using gomyfinance.com to create a budget

Begin with a realistic review of your monthly income. Do not overestimate it. Include all reliable sources such as salary, part-time work, freelancing, or recurring passive income.

Track every expense, even the small ones. Coffee, snacks, and digital subscriptions may seem minor but can make a significant difference over time. The create budget tool on gomyfinance.com includes small and large categories, ensuring full visibility.

Review your budget weekly to adjust your spending where necessary. For example, if your dining out category is frequently over budget, either reduce your spending or reallocate funds from another category.

Make use of the notes or tags feature to mark one-time expenses, seasonal costs, or recurring payments. This helps with long-term planning.

Use the platform’s reminders and alerts. These notifications can help you avoid overstepping your limits or forgetting due bills.

Can gomyfinance.com help with debt management

Yes, the create budget tool allows you to enter your debt payments and track progress. You can allocate part of your income to specific loans or credit card payments. Over time, this visibility encourages smarter repayment strategies and helps users avoid late fees or missed payments.

Is the gomyfinance.com budget tool suitable for all users

This tool is designed for a wide audience. It can be used by:

-

College students managing allowances

-

Working professionals budgeting for rent, food, and transport

-

Families planning monthly household finances

-

Freelancers with irregular income

-

Retirees living on fixed budgets

The interface is beginner-friendly and does not require accounting knowledge. Yet, it is detailed enough to serve advanced users who want in-depth analysis and financial tracking.

How secure is your budget data on gomyfinance.com

Security is a key feature. All budget data entered is encrypted. The platform uses secure login protocols to protect your account and privacy. Data is stored on secure servers and is not shared with third parties without consent.

What makes gomyfinance.com create budget stand out

There are many budgeting tools available, but gomyfinance.com offers some distinct advantages. It allows category customization, tracks real-time balances, provides clear visual breakdowns, and does not overwhelm the user with ads or upsells. Unlike generic templates, it adapts to your personal finance structure.

The intuitive design also means users spend less time managing spreadsheets and more time acting on financial goals.

Summary

The gomyfinance.com create budget feature is a reliable, user-friendly solution for managing finances online. It gives you the tools to plan income, control expenses, and build savings without needing technical skills. Whether you want to get out of debt, plan a vacation, or simply understand your cash flow, this tool provides clarity and control. If used consistently, it can change how you handle money, one budget at a time.

To explore more helpful guides like this one, visit Magazines Break.

FAQs

How can I create a budget on gomyfinance.com

Log into your account, go to the Budget section, input income and expenses, categorize them, assign values, and save the budget.

Is gomyfinance.com suitable for household budgeting

Yes, it can handle multiple income sources and shared expenses, making it ideal for household use.

Does the tool support one-time and recurring expenses

Yes, it allows users to mark transactions as recurring or one-time for better tracking.

Can I adjust my budget if my income changes

You can edit your income and expenses anytime. The dashboard updates accordingly.

Is the budget data saved permanently

Yes, all budget data is stored securely and is accessible whenever you log in.

Does gomyfinance.com offer visual summaries

Yes, the tool includes charts and graphs to show how you are spending over time.

Can I set savings goals in the budget

Yes, you can create separate goals and allocate funds toward them within your monthly budget.

Is this tool mobile friendly

Yes, it works well on mobile browsers, making it easy to manage your budget on the go.

Can I link my bank account to gomyfinance.com

Bank linking may be supported in select regions for automatic transaction importing.

Do I need financial experience to use the tool

No, it is built for users with no financial background. The interface is intuitive and guided.